Get the free texas property tax deferral form

Show details

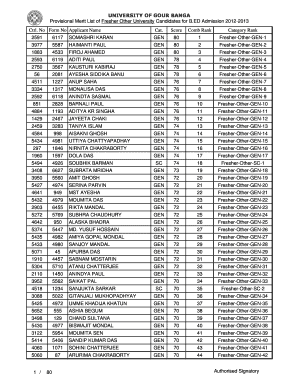

Harris County Appraisal District Exemption Center P. O. Box 922012 Houston Texas 77292-2012 713 957-7800 Form 33. 06 01/13 Tax Deferral Affidavit Over-65 Homestead or Disabled Homeowner Tax Year Account Number NEWHS124 If you are a homeowner age 65 or over or disabled you can defer or postpone paying delinquent property taxes on your homestead for as long as you own it and live in it.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deferral affidavit form

Edit your deferred property taxes in texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deferral affidavit texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing defer property taxes in texas online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit harris county tax office forms. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out excise tax affidavit form

How to fill out tax deferral affidavit harris:

01

Obtain the tax deferral affidavit form. This can typically be found on the website of the relevant tax authority or through a tax professional.

02

Carefully read the instructions provided with the form. These instructions will guide you through the process of completing the affidavit accurately.

03

Fill in your personal information. This will include your name, address, Social Security number, and any other requested identification details.

04

Provide information about the taxes you wish to defer. This may include the tax year, amount owed, and any applicable account numbers.

05

Include any supporting documentation as required. This may include copies of tax returns, notices from the tax authority, or other relevant paperwork.

06

Ensure you sign and date the affidavit. Failure to sign the form can result in it being considered invalid.

07

Review the completed form for accuracy and completeness. Make any necessary corrections before submitting it.

08

Submit the completed tax deferral affidavit to the appropriate tax authority. This may involve mailing it to a specific address or submitting it through an online portal.

Who needs tax deferral affidavit harris:

01

Individuals who are facing financial hardship and are unable to pay their taxes in full and on time.

02

Taxpayers who meet the eligibility criteria set forth by the tax authority for tax deferral.

03

Individuals who have received communication from the tax authority indicating that they are eligible to defer their taxes and are required to submit a tax deferral affidavit.

Fill

property tax deferment account

: Try Risk Free

People Also Ask about tax deferral form

How to reduce property taxes in Harris County?

Ensure that you have taken all exemptions to which you qualify or are legally entitled: Homestead exemption. Homeowners with disabilities exemption. Over-65 exemption. Disabled veteran. Survivor exemption. Exemptions remove part of the value of your property from taxation and lower your taxes.

What is the property tax code deferral in Texas?

Property Tax and Appraisals The Texas Tax Code, Section 33.06, allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled after death.

How does property tax deferral work in Texas?

There are no penalties on delinquent taxes during the deferral period; however, a tax deferral does not cancel penalties that were already due. All deferred taxes and interest become due when the homeowner or surviving spouse no longer own and live in the home.

What is the tax code deferral in Texas?

Section 33.06 - Deferred Collection of Taxes on Residence Homestead of Elderly or Disabled Person or Disabled Veteran (a) An individual is entitled to defer collection of a tax, abate a suit to collect a delinquent tax, or abate a sale to foreclose a tax lien if: (1) the individual: (A) is 65 years of age or older; (B)

What is a Harris County tax deferral affidavit?

To postpone your tax payments, file a tax deferral affidavit with your appraisal district. The deferral applies to delinquent property taxes for all of the taxing units that tax your home. You should be aware that a tax deferral only postpones payments, it does not cancel them.

How do I file a tax deferral in Texas?

Filing. To obtain a tax deferral, an individual must file the tax deferral affidavit with the appraisal district of the county they reside in. Please refer to What is A Property Tax Deferral information sheet (PDF) to learn how a property tax deferral may affect you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find declaration of trust pdf?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific harris county tax exemptions and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit pennsylvania tax exempt certificate in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your duty deferral, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out texas property tax deferral on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your texas property tax deferral, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is tax deferral affidavit harris?

The tax deferral affidavit for Harris is a document used to request a postponement of property tax payments based on certain eligibility criteria, often related to age, disability or financial hardship.

Who is required to file tax deferral affidavit harris?

Typically, individuals who are elderly, disabled, or experiencing financial hardship may be required to file the tax deferral affidavit in Harris County to qualify for deferring their property taxes.

How to fill out tax deferral affidavit harris?

To fill out the tax deferral affidavit for Harris, individuals must complete the required form by providing personal details, eligibility information, and any supporting documentation required, ensuring all sections are filled accurately to avoid delays.

What is the purpose of tax deferral affidavit harris?

The purpose of the tax deferral affidavit in Harris is to allow eligible individuals to postpone the payment of property taxes, thereby providing financial relief and assistance to those who may be struggling.

What information must be reported on tax deferral affidavit harris?

The information that must be reported on the tax deferral affidavit includes the applicant's name, address, the reason for deferral, income information, and any other financial data that demonstrates eligibility for the deferral.

Fill out your texas property tax deferral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Property Tax Deferral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.